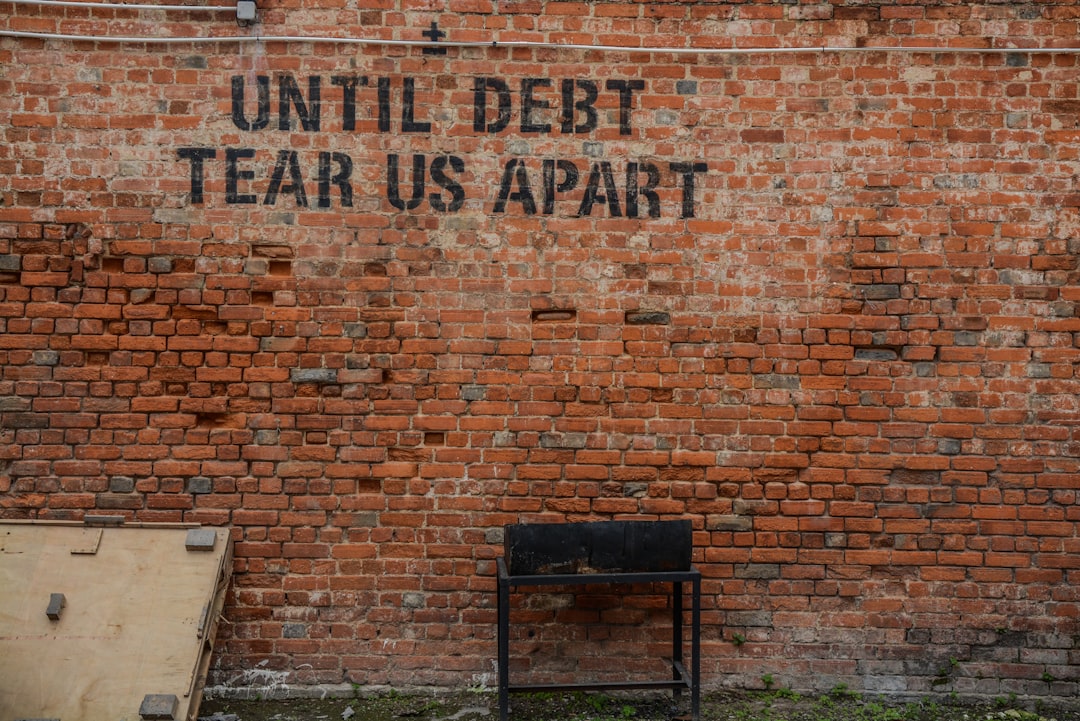

An unsecured debt consolidation loan combines multiple high-interest credit card balances into a single lower-interest loan, simplifying repayment and saving money. Based on creditworthiness, these loans offer flexible terms without collateral. By choosing the right lender and repayment strategy (like the snowball or avalanche method), borrowers can reduce stress, improve cash flow, and enhance future borrowing opportunities. Success stories highlight the positive impact of consolidating debts through this proven strategy.

Looking to escape the cycle of high credit card interest rates? Unsecured debt consolidation loans offer a strategic path to pay off your balances efficiently. This article explores what an unsecured debt consolidation loan is and how it can be used to simplify multiple credit card debts. We delve into the benefits, including lower monthly payments and consolidated repayment terms. Learn about the loan process, choosing the right provider, and effective strategies for successful debt elimination. Discover real-world success stories and take control of your financial future today.

- Understanding Unsecured Debt Consolidation Loans

- Benefits of Using Debt Consolidation for Credit Card Debts

- How Unsecured Loans Work in Debt Consolidation

- Choosing the Right Loan Provider and Terms

- Effective Strategies for Repaying Consolidated Credit Card Debt

- Real-World Success Stories: Debt Consolidation in Action

Understanding Unsecured Debt Consolidation Loans

An unsecured debt consolidation loan is a type of financing option designed to simplify and streamline multiple high-interest debts into a single, more manageable loan. Unlike secured loans that require collateral, unsecured loans rely solely on the borrower’s creditworthiness and repayment history. This makes them accessible to individuals who may not have substantial assets to pledge as security but still need help managing their debt burden.

When you consolidate your credit card balances with an unsecured debt consolidation loan, you’re essentially taking out a new loan at a potentially lower interest rate, which is then used to pay off your existing credit cards. This strategy can offer several benefits: it simplifies repayment by combining multiple debts into one fixed monthly payment, potentially saves money on interest charges, and improves cash flow by freeing up the funds previously allocated for various credit card payments.

Benefits of Using Debt Consolidation for Credit Card Debts

Using an unsecured debt consolidation loan to pay off credit card balances can offer several significant advantages. One of the primary benefits is simplifed financial management. Instead of making multiple payments to various creditors, a consolidation loan allows borrowers to combine all their credit card debts into a single payment, streamlining the process and potentially reducing monthly expenses.

Additionally, debt consolidation loans often come with lower interest rates compared to credit cards. This can result in substantial savings over time as borrowers pay off their debts more efficiently. By consolidating credit card debts, individuals can also improve their credit score by demonstrating responsible financial management, which can open up opportunities for future borrowing and better terms on loans.

How Unsecured Loans Work in Debt Consolidation

Unsecured loans play a significant role in debt consolidation strategies, especially for those looking to pay off credit card balances. A What Is An Unsecured Debt Consolidation Loan? is a type of financing that does not require borrowers to put up any collateral. This makes it an attractive option for individuals who may not have substantial assets to offer as security. The loan amount is instead based on the borrower’s creditworthiness, typically determined by their credit score and history.

When used for debt consolidation, unsecured loans allow borrowers to combine multiple high-interest credit card debts into a single loan with a potentially lower interest rate. This streamlines repayment by consolidating all debts into one manageable payment, often making it easier to stick to a budget. Additionally, unsecured loans can offer flexible terms, providing relief from the strict repayment schedules often associated with credit cards.

Choosing the Right Loan Provider and Terms

When considering debt consolidation loans to pay off credit card balances, selecting the right loan provider and terms is pivotal. It’s essential to differentiate between secured and unsecured options, with an unsecured debt consolidation loan being a popular choice as it doesn’t require collateral. This type of loan is based solely on your creditworthiness, making it accessible to many.

Researching lenders thoroughly is key; compare interest rates, repayment periods, and any additional fees or conditions. Look for transparent terms that align with your financial goals and ability to repay. Reputable lenders will offer tailored solutions, allowing you to consolidate multiple credit card debts into a single, more manageable loan with potentially lower interest rates.

Effective Strategies for Repaying Consolidated Credit Card Debt

After consolidating your credit card balances with an unsecured debt consolidation loan, implementing effective repayment strategies is key to achieving financial freedom. One proven method is the debt snowball approach, where you prioritize paying off debts from the smallest balance to the largest, regardless of interest rates. This strategy provides a psychological boost as you see debts disappear faster. Alternatively, consider the debt avalanche method, focusing on debts with the highest interest rates first. While it might not feel as satisfying in the short term, it saves you more money in the long run.

Regularly reviewing your budget and adjusting as necessary is also vital. Track your expenses and income to ensure each dollar is allocated wisely. Set up automatic payments for your consolidation loan to avoid missed deadlines, which can incur additional fees. Remember that consistent effort and discipline are required to repay consolidated credit card debt successfully.

Real-World Success Stories: Debt Consolidation in Action

Debt consolidation is a powerful tool that has helped countless individuals take control of their finances and achieve debt freedom. One of the most common methods is through unsecured debt consolidation loans, which allow borrowers to combine multiple high-interest debts into one manageable loan with a lower interest rate.

Real-world success stories abound, showcasing how this strategy can transform financial situations. For instance, consider Sarah, who had accumulated credit card balances across several accounts, each charging varying rates. After researching her options, she opted for an unsecured debt consolidation loan to pay off these debts. By consolidating, Sarah significantly reduced her monthly payments and eliminated the stress of managing multiple due dates. Similarly, David, a young professional with student loans and credit card debt, used a consolidation loan to simplify his financial obligations and free up funds for other priorities, like saving for a down payment on a home. These stories illustrate how debt consolidation can offer clarity, reduced stress, and improved financial stability.

Debt consolidation using unsecured loans can be a strategic move to gain control over credit card balances. By understanding the process, leveraging its benefits, and choosing the right lender, individuals can navigate their debt effectively. With careful planning and repayment strategies, consolidating credit card debts through unsecured loans can lead to financial freedom, offering a clear path to paying off debts once and for all.